Last Update: October 27, 2024

Order blocks are one of the most useful ICT strategy elements. An order block (OB) is a price level on the chart from which the market is likely to bounce. Many Smart Money Concepts (SMC) or ICT traders use OBs as an entry zone or sometimes as a take-profit level.

I personally use Order Blocks for entries and exits, but mostly the latter. In fact, I prefer entering on Fair Value Gaps. However, after years of trading ICT concepts, I can assure you it can only be a matter of personal preferences. Either way, I will explain what is an order block and how you can trade it.

Note: If you don’t know the basics about the Inner Circle Trading strategies, check out this comprehensive ICT trading concepts guide first.

- An order block represents a price zone where institutional traders have executed large orders, making it a likely area for the price to react and bounce.

- There are two types—bullish order blocks, which signal buying zones, and bearish order blocks, which signal selling zones.

- Order block mitigations occur when the price returns to an OB, allowing institutional traders to fill the rest of their orders.

- OBs often form after liquidity hunts, initiating strong price movements, and are useful in forex, crypto, stocks, and indices trading.

- You should identify OBs by looking for market trends, using the base of moves, and combining price action analysis with volume indicators.

- Traders often mistake invalid OBs, ignore market context, rely too much on OBs, and place stop losses too close.

- Key risk management tips include not risking more than 2% per trade, locking in profits, waiting for liquidity sweeps before entering trades, and not overcomplicating strategies.

What Is an Order Block in Trading?

An ICT order block is a specific level or zone where institutional traders, like banks and hedge funds, have executed their large trades. Therefore, the market is likely to react to and bounce from an OB, as the institutions will likely defend their positions. Therefore, ICT traders use OBs as entry or exit levels.

Remember, Order Blocks can be retested quickly or even after a while. Either way, a valid OB is likely to initiate a significant move away from it if the price comes back for a retest.

Types of Order Blocks

Now, OBs can either be bullish or bearish:

- Bullish Order Block: A consolidation zone that leads to a significant bullish price move and can push the price higher if it gets retested.

- Bearish Order Block: A consolidation zone that leads to a significant bearish trend and can push the price back lower if it gets retested.

So, a bullish orderblock can simply be defined as an area where institutional investors have executed large buy orders. On the other hand, bearish OBs are zones where the market makers execute large sell orders.

What Is an Order Block Mitigation and Why Does It Happen?

An order block mitigation occurs when the price pulls back to the OB. The reason behind mitigations and pullbacks is that institutional players mostly enter the market in steps and not in one single order. This is because they do not want their large orders to move the market significantly so that they get filled in suboptimal price levels. As a result, the markets are likely to return to OBs to allow another chance of entry for the smart money and then continue in the initial direction.

Why Are Order Blocks Important?

The importance of OBs in trading is directly related to the fact that they demonstrate where the institutional entities have entered the market. Many traders often point to the similarities between OBs and supply and demand zones. Classical price action traders also see them as support and resistance levels.

Yet, the primary distinction between ICT OBs and the other concepts mentioned is the fact that OBs mostly form after liquidity hunts (inducements), as they might initiate considerable price movements.

As already mentioned, you can use order block trading concepts for both entry and exit signals. This means that you can either buy at a bullish OB, sell at a bearish one, or even take profits on your open positions at opposing OBs. So, they can have the same function as Fair Value Gaps or liquidity voids and can also assist in evaluating the market sentiment.

Overall, while most might assume that orderblocks only work in forex, this is far from the truth. Many ICT traders can testify that OBs also work in crypto, stocks, and indices trading.

How to Identify Order Blocks?

There are many methods and ideas on how to identify an order block. However, as an ICT trader, I’ll explain how I personally do it.

The first and most important step in identifying an OB is to determine current market conditions in the specific timeframe you trade. There are two possible scenarios here:

- Trending: If the market is trending, you should look back at recent price action to find where the current trend has begun (the base of the move). That would be your OB area.

- Consolidating: If the market is moving rangebound, it is most likely creating an OB either on your reference timeframe or the higher timeframe.

As I always prefer to trade in trending market conditions, I will move on to find the exact OB when the first scenario is true.

To spot an OB when the market has been trending higher, I will look at the base of the current move as the bullish order block zone. The last few bearish candles before the bullish move has begun will show the exact bullish orderblock level.

Similarly, to find OBs when the market trend is bearish, the base of the current downtrend will be the bearish order block area. Again, the last few bullish candles before the drop would indicate the exact bearish orderblock zone.

Moreover, you can use tools and methods other than price action analysis and simple tape reading. For instance, there are a lot of order block indicators on TradingView that you can apply to your chart. Another technique I personally like is using the volume indicator, as the formation of an OB is usually accompanied by increases in volume.

Differences between Valid and Invalid Order Blocks

I personally use these 4 criteria when it comes to determining which OB is valid and which is not:

- Formed after Inducement: Valid order blocks mostly form after liquidity hunts (inducements).

- Lead to Displacement: A valid OB should begin an aggressive market move (displacement), which creates Fair Value Gaps (imbalances).

- Spike in Volume: The volume indicator should show a spike during the formation of a valid OB, as institutional entities are executing their orders.

If an OB doesn’t show the characteristics above, especially the first two, I consider them to be invalid.

How to Use Order Blocks in Trading?

Now, let’s talk about how you can apply trading strategies using order blocks. Note that while most traders only use order block strategies, which use OBs as the sole entry criteria, you can add and implement this element in other trading strategies.

Yet, my explanation will revolve around how I personally use OBs to trade forex. So, let me describe my order block trading strategy step by step, using a practical example:

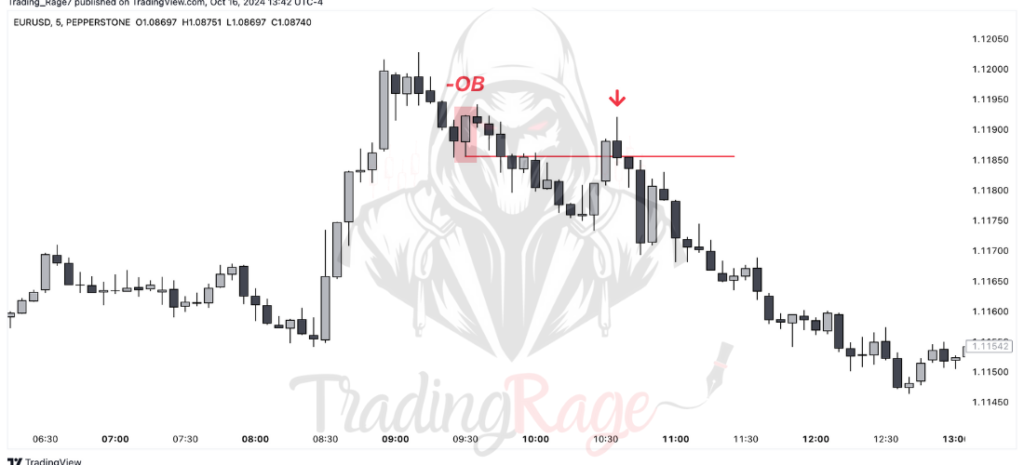

Daily Bias or Trend Identification

The first step for every intraday trader to find setups is to assess the overall market structure and daily bias. Take a look at the EUR/USD chart below on the 5-minute timeframe. The bearish market structure is quite clear. Therefore, we’ll be looking for sell opportunities.

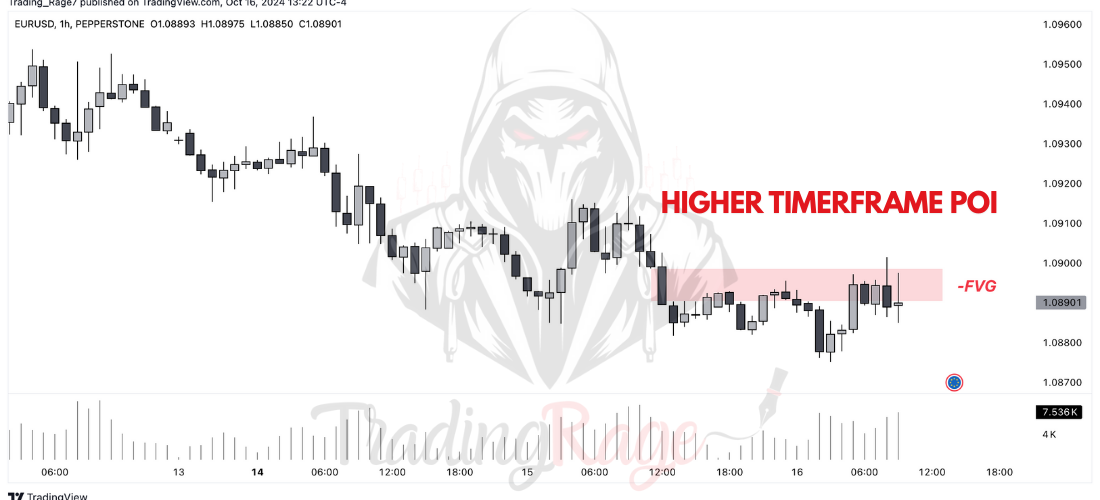

Looking for Higher Timeframe POI

The next step for finding an ideal setup is to identify a higher timeframe point of interest from which the price will react. The hourly chart below shows a clear bearish fair value gap that’s holding the price, and could be a good zone too look for sell setups on the lower timeframe.

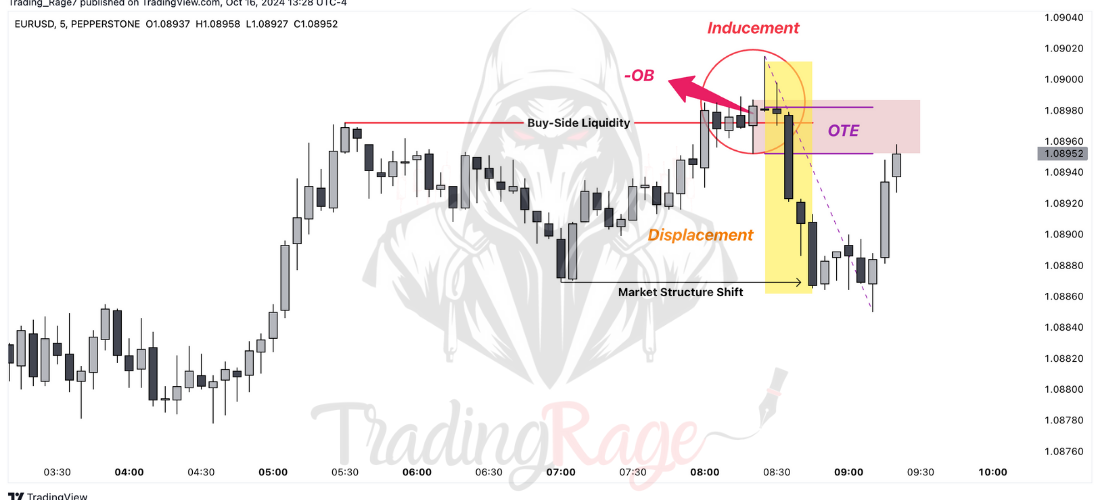

Identifying Valid OBs

Dropping back to the lower timeframe, I’ll be looking for a valid OB, which has formed after an inducement (liquidity sweep) and caused a displacement. Both are present in the 5-minute chart below. The fact that the OB has also caused a clear market structure shift and is located in the ICT Optimal Trade Entry (OTE) adds even more confluence that the bearish order block is likely valid. I will use this OB for my entry.

Stop Loss and Target Placement

The final step is to set stop-loss and take-profit orders and actually enter the trade. I prefer setting the stop loss above the recent high and the take profit at the sell-side liquidity pool below. My entry will be on the lower boundary of the Orderblock. I would also recommend entering in trades only during ICT Killzones.

Evidently, the price has retested the OB, and I’ve executed the sell order. The market has then dropped to my target.

This was a clear step-by-step ICT order block strategy I personally use. Feel free to modify details to create your own system. For more trade examples, check out my ICT trades journal.

Common Mistakes in Order Block Trading

When trading OBs, there are some common mistakes that can negatively impact your results. Here’s a summary of key pitfalls to avoid:

1. Trading Invalid Order Blocks: A common mistake is incorrectly identifying valid order blocks. Traders often mistake regular price zones for OBs without properly recognizing a liquidity sweep or significant move afterward.

2. Ignoring Daily Bias: Trading based solely on order blocks without considering the market structure and daily bias can lead to losses.

3. Relying Exclusively on OBs: Many ICT traders fall into the trap of using only Orderblocks as their primary trading signal. Try to use concepts like the ICT Power of 3, Fair Value Gaps, and Optimal Trade Entries (OTE) for more confluence.

4. Placing Stop Losses Too Close: Another frequent mistake is placing stop-loss orders too close to the OB. Setting your stop-loss orders above or below recent highs and lows can increase your win rate significantly.

5. Overcomplicating: While I just mentioned that you should use other ICT trading concepts, keep things simple. Stick to a handful of tools for your order block trading strategy.

Risk Management Tips for Trading Order Blocks

Here are five key risk management tips based on my personal trading experience of over 6 years:

- Never Risk Too Much: Always use stop-loss orders and never risk more than 2% of your account on an individual trade (as a day trader). You should also have defined criteria for optimal risk-reward ratios, position sizing, and stop-loss placement.

- Pay Yourself Frequently: Just as you set stop-loss orders, it’s essential to define profit targets. Always lock in some profits early on to have a drawdown buffer for the rainy days.

- Never Enter Before Liquidity Sweeps: As I already mentioned, valid order blocks form after inducement. So, never enter on OBs above or below support and resistance levels.

- Order Blocks Are Not the Holy Grail: While OBs might show institutional activity, they can still fail. So, make sure to have a specific trading plan and look long-term to gain a statistical edge.

- Don’t Get Confused: OBs can be quite similar to breaker blocks and mitigation blocks. Make sure to fully understand what is an order block, and don’t confuse it with other ICT concepts.

Conclusion

OBs are one of the key elements in ICT trading concepts. In this article, I explained what is an order block and how my order block strategy works. I also presented some risk management tips and common mistakes traders make when trading OBs.

I personally use both OBs and fair value gaps alongside other ICT concepts like the power of 3. If you’re just learning about these concepts, make sure you test your OB trading strategy on demo accounts and backtest it before applying it with live funds.

FAQ

What is an order block in ICT trading concepts?

An ICT OB is a price area marked by institutional buying or selling, acting as potential support (bullish OB) or resistance (bearish OB) when retested.

What is an example of order blocks?

OBs are price zones where institutions place large orders. For example, in a bullish market, the last bearish candle before an upward move may mark a buying zone, often acting as support on retests.

How is an order block valid?

Valid OBs form after liquidity sweeps, show strong price moves (displacement), and typically coincide with volume spikes.

How to identify order blocks in crypto?

In crypto, find the last bearish candle before a rally in uptrends (bullish OB) or the last bullish candle before a drop in downtrends (bearish OB). Volume and price imbalance help confirm the OB.

Is order block a good strategy?

Yes, OBs can be effective, especially when combined with ICT tools like fair value gaps, liquidity sweeps, and proper risk management.

Is the order block the same as the fair value gap?

No, OBs are institutional trading zones, while fair value gaps are price imbalances that often follow OBs and serve as additional support or resistance.